All Categories

Featured

Table of Contents

Coverage quantity selected will certainly be the same for all covered youngsters and may not exceed the face amount of the base plan. Issue ages begin at 1 month via less than 18 years of ages. Plan ends up being exchangeable to a whole life plan in between the ages of 22 to 25. A handful of variables affect exactly how much last expenditure life insurance coverage you truly need.

Disclosures This is a general description of protection. A complete declaration of insurance coverage is discovered only in the policy. For even more details on coverage, costs, restrictions, and renewability, or to obtain protection, contact your local State Farm agent. There are limitations and problems pertaining to settlement of benefits due to misstatements on the application or when fatality is the result of self-destruction in the first 2 plan years.

Permanent life insurance policy creates money worth that can be obtained. The amount of money value offered will generally depend on the kind of long-term plan purchased, the quantity of insurance coverage bought, the length of time the plan has been in force and any outstanding policy finances.

Final Expense Tx

State Farm producers do not provide tax or lawful recommendations. Additionally, neither State Farm nor its manufacturers give investment suggestions, except in certain limited scenarios associating with tax-qualified taken care of annuities and life insurance policy plans funding tax-qualified accounts. Please consult your tax obligation or legal advisor regarding your specific situations. This policy does not ensure that its proceeds will certainly suffice to spend for any type of specific service or goods at the time of requirement or that solutions or merchandise will certainly be supplied by any type of specific provider.

The very best way to make sure the policy quantity paid is spent where planned is to name a beneficiary (and, sometimes, an additional and tertiary beneficiary) or to place your dreams in a surviving will and testament. It is typically a great technique to inform main beneficiaries of their expected responsibilities when a Last Expense Insurance coverage is gotten.

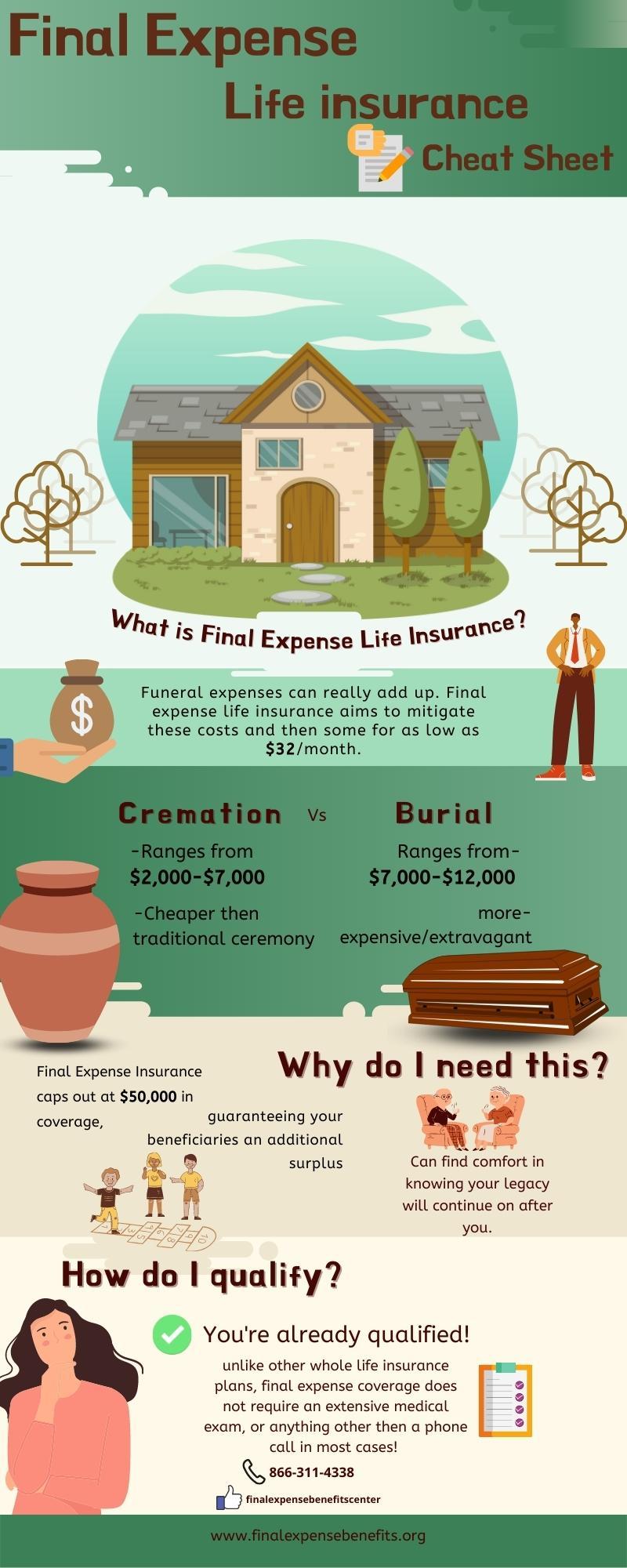

Costs begin at $21 per month * for a $5,000 coverage policy (premiums will certainly vary based on concern age, gender, and insurance coverage amount). No clinical evaluation and no health and wellness inquiries are required, and consumers are assured protection with automated credentials - ohio burial insurance.

Below you will certainly discover some often asked inquiries need to you choose to use for Last Cost Life Insurance Policy by yourself. Corebridge Direct accredited life insurance coverage agents are waiting to address any extra inquiries you may have relating to the protection of your enjoyed ones in case of your passing away.

They can be made use of on anything and are created to help the beneficiaries prevent a financial crisis when a loved one passes. Funds are often used to cover funeral prices, medical costs, paying off a home mortgage, automobile financings, or also made use of as a nest egg for a brand-new home. If you have sufficient savings to cover your end-of-life expenditures, after that you might not need last cost insurance policy.

In enhancement, if you've been unable to get larger life insurance policy plans due to age or medical conditions, a last cost plan may be a budget friendly option that minimizes the burden positioned on your family members when you pass. Yes. Last expense life insurance policy is not the only method to cover your end-of-life prices.

Seniors Funeral Insurance

These normally provide greater coverage quantities and can secure your family's way of life along with cover your last expenditures. Connected: Entire life insurance policy for senior citizens.

The application procedure fasts and simple, and protection can be released in days, occasionally even on the day you use. As soon as you have actually been approved, your protection begins instantly. Your policy never ever expires so long as your premiums are paid. Final cost plans can construct cash money worth with time. Once the cash money worth of your policy is high enough, you can take out cash from it, utilize it to borrow money, and even pay your costs.

Final Expense Fund

There are a number of costs connected with a fatality, so having final expense coverage is essential. Several of the fundamentals covered include: Funeral arrangements, including embalming, coffin, blossoms, and solutions Interment prices, consisting of cremation, interment plot, headstone, and interment Outstanding medical, lawful, or charge card expenses Once the funds have been paid out to your beneficiary, they can use the cash any type of means they desire.

Simply make sure you pick someone you can depend allot the funds properly. Progressive Responses - funeral insurance for over 65 is your resource for all points life insurance, from just how it functions to the kinds of policies available

This fatality benefit is normally related to end-of-life expenditures such as clinical expenses, funeral costs, and a lot more. Picking a last cost insurance coverage option is among the several steps you can require to prepare your family members for the future. To aid you much better comprehend the ins and outs of this kind of entire life insurance policy policy, allow's take a better consider exactly how final cost insurance coverage functions and the sorts of policies that might be readily available for you.

Not every final expenditure life insurance coverage policy coincides. Depending on your health and just how much you are able to afford in costs, there is a policy choice that is ideal for you. Here are a few of the various survivor benefit kinds related to a final expenditure plan. An instant or standard final expenditure insurance coverage permits recipients to receive complete death benefits anytime or exactly how the insurance holder passed away after the begin of the insurance coverage.

As an example, a graded advantage plan might have it to ensure that if the insured passes during the first year of the plan, up to 40 percent of the benefit will be offered to the beneficiaries. If the insured passes away within the second year, approximately 80 percent of the benefits will most likely to the recipients.

Life Final Cover

An assured problem final expense insurance plan requires a two- to three-year waiting duration prior to being qualified to get benefits. If the insured individual passes away before completion of this waiting duration, the recipients will not be qualified to obtain the fatality benefit. Nonetheless, they might get a return of the costs that have actually been paid with rate of interest.

Relying on your health and wellness and your finances, some policies may be much better suited for you and your family members over the various other choices. In basic, final expense life insurance is fantastic for anybody seeking a budget friendly policy that will aid cover any kind of superior equilibriums and funeral costs. The price of costs has a tendency to be lower than traditional insurance coverage, making them quite affordable if you are trying to find something that will fit a limited spending plan.

Affordable Funeral Cover

An instant last expenditure plan is a great option for any individual who is not in great wellness because beneficiaries are eligible to get advantages without a waiting duration. A survey on the health and wellness and case history of the insurance policy holder might determine just how much the premium on this plan will be and affect the death advantage quantity.

Someone with major health and wellness conditions might be denied other types of life insurance, however a guaranteed concern plan can still give them with the protection they need. Preparing for end-of-life costs is never ever an enjoyable conversation to have, however it is one that will aid your household when encountering a challenging time.

Fidelity Burial Insurance

It can be unpleasant to consider the expenditures that are left behind when we pass away. Failure to intend in advance for a cost might leave your family owing hundreds of bucks. Oxford Life's Assurance last cost whole life insurance policy plan is a cost-effective means to help cover funeral expenses and various other costs left.

Latest Posts

Final Expense South Carolina

Best Way To Sell Final Expense Insurance

Funeral Policies For Over 60