All Categories

Featured

Table of Contents

Passion will certainly be paid from the day of fatality to day of payment. If fatality results from natural causes, death profits will certainly be the return of costs, and passion on the premium paid will be at a yearly reliable rate specified in the policy agreement. Disclosures This plan does not assure that its profits will suffice to pay for any kind of particular solution or goods at the time of demand or that services or product will certainly be offered by any kind of specific supplier.

A total statement of coverage is located only in the policy. For more information on coverage, expenses, restrictions; or to request protection, get in touch with a neighborhood State Ranch agent. There are limitations and problems relating to settlement of advantages as a result of misrepresentations on the application. final expense insurance vs. life insurance. Dividends are a return of costs and are based on the real mortality, cost, and investment experience of the Company.

Irreversible life insurance establishes cash money value that can be borrowed. Plan financings accumulate passion and unpaid policy car loans and passion will certainly reduce the fatality benefit and money worth of the plan. The amount of cash money value offered will typically rely on the kind of irreversible policy bought, the quantity of protection acquired, the size of time the plan has been in pressure and any type of outstanding policy finances.

Our opinions are our very own. Funeral insurance coverage is a life insurance coverage policy that covers end-of-life expenditures.

Funeral insurance coverage needs no medical exam, making it obtainable to those with clinical conditions. This is where having funeral insurance coverage, likewise known as final cost insurance policy, comes in helpful.

Streamlined concern life insurance coverage requires a health and wellness evaluation. If your wellness status invalidates you from standard life insurance policy, funeral insurance coverage might be a choice.

Online Funeral Insurance

, interment insurance coverage comes in numerous forms. This policy is best for those with mild to moderate health conditions, like high blood stress, diabetes mellitus, or bronchial asthma. If you don't want a medical exam but can certify for a streamlined issue policy, it is generally a much better deal than an assured issue plan because you can obtain more coverage for a more affordable premium.

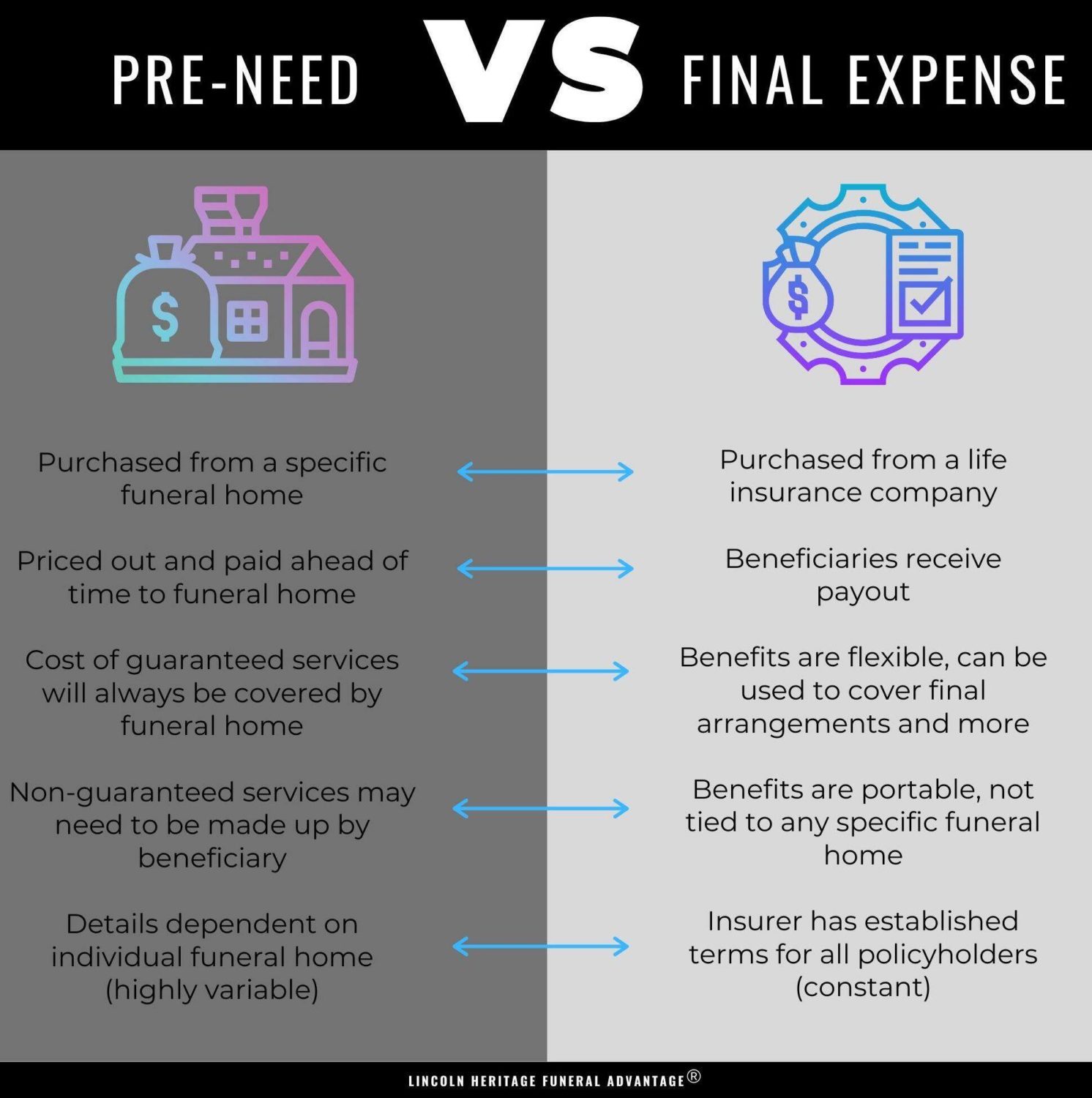

Pre-need insurance is dangerous since the beneficiary is the funeral home and coverage is details to the chosen funeral home. Ought to the funeral chapel fail or you vacate state, you may not have protection, which defeats the function of pre-planning. Additionally, according to the AARP, the Funeral Service Consumers Partnership (FCA) advises versus getting pre-need.

Those are essentially burial insurance coverage. For guaranteed life insurance, premium estimations depend upon your age, gender, where you live, and insurance coverage amount. Understand that coverage quantities are restricted and differ by insurance service provider. We discovered sample quotes for a 51-year-woman for $25,000 in coverage living in Illinois: You might determine to opt out of funeral insurance coverage if you can or have actually conserved up adequate funds to pay off your funeral service and any kind of arrearage.

Final Cost Insurance

Interment insurance supplies a streamlined application for end-of-life insurance coverage. A lot of insurance provider require you to talk to an insurance coverage representative to make an application for a policy and acquire a quote. The insurance representatives will certainly request for your individual information, call details, monetary info, and coverage choices. If you decide to purchase an assured issue life policy, you won't have to undergo a medical test or questionnaire - online funeral policy.

The objective of having life insurance is to ease the concern on your loved ones after your loss. If you have a supplemental funeral plan, your liked ones can utilize the funeral plan to deal with final expenditures and obtain a prompt disbursement from your life insurance policy to take care of the home loan and education costs.

People who are middle-aged or older with medical problems may consider funeral insurance coverage, as they could not get conventional plans with stricter authorization requirements. Furthermore, funeral insurance policy can be handy to those without considerable financial savings or standard life insurance policy coverage. best final expense insurance companies to work for. Funeral insurance policy differs from various other kinds of insurance in that it offers a reduced survivor benefit, generally only enough to cover expenditures for a funeral service and various other connected prices

Information & World Record. ExperienceAlani is a previous insurance coverage other on the Personal Finance Expert group. She's examined life insurance policy and family pet insurer and has actually written various explainers on travel insurance policy, credit score, financial obligation, and home insurance. She is enthusiastic concerning debunking the complexities of insurance policy and other personal money subjects to ensure that readers have the details they require to make the very best cash choices.

Life And Burial Insurance Companies

The even more insurance coverage you obtain, the greater your costs will certainly be. Last expense life insurance coverage has a number of advantages. Specifically, everybody that uses can get accepted, which is not the instance with other types of life insurance policy. Final expense insurance coverage is often recommended for seniors who might not certify for conventional life insurance policy due to their age.

Additionally, final cost insurance coverage is beneficial for people who wish to spend for their very own funeral service. Funeral and cremation services can be expensive, so final expense insurance coverage supplies assurance recognizing that your liked ones will not need to use their cost savings to pay for your end-of-life plans. Nevertheless, last expense insurance coverage is not the best product for everyone.

Obtaining whole life insurance policy with Ethos is fast and simple. Insurance coverage is offered for seniors in between the ages of 66-85, and there's no clinical exam required.

Based on your feedbacks, you'll see your estimated rate and the quantity of protection you receive (in between $1,000-$ 30,000). You can acquire a plan online, and your protection starts promptly after paying the very first costs. Your rate never ever transforms, and you are covered for your whole lifetime, if you continue making the monthly repayments.

Funeral Insurance Expenses

Last cost insurance policy provides advantages but requires careful factor to consider to determine if it's right for you. Life insurance policy can resolve a range of economic needs. Life insurance policy for final costs is a sort of irreversible life insurance created to cover prices that develop at the end of life - final expense insurance no waiting period. These policies are relatively easy to get, making them perfect for older individuals or those that have health and wellness concerns.

According to the National Funeral Service Directors Association, the average price of a funeral with interment and a watching is $7,848.1 Your loved ones could not have access to that much money after your fatality, which might add to the anxiety they experience. In addition, they might encounter various other prices connected to your passing.

It's usually not pricey and reasonably easy to obtain (senior care usa final expense insurance reviews). Final expenditure protection is in some cases called burial insurance policy, yet the cash can spend for practically anything your liked ones require. Beneficiaries can make use of the death benefit for anything they require, permitting them to resolve one of the most important economic priorities. In many cases, enjoyed ones spend money on the following products:: Spend for the interment or cremation, checking out, place rental, officiant, flowers, catering and much more.

: Work with professionals to aid with handling the estate and browsing the probate process.: Shut out make up any end-of-life treatment or care.: Repay any kind of various other financial obligations, including car loans and credit scores cards.: Beneficiaries have full discernment to use the funds for anything they require. The cash might even be made use of to create a legacy for education expenditures or given away to charity.

Latest Posts

Final Expense South Carolina

Best Way To Sell Final Expense Insurance

Funeral Policies For Over 60